Social security wages calculation w2

Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income. Health subtract the.

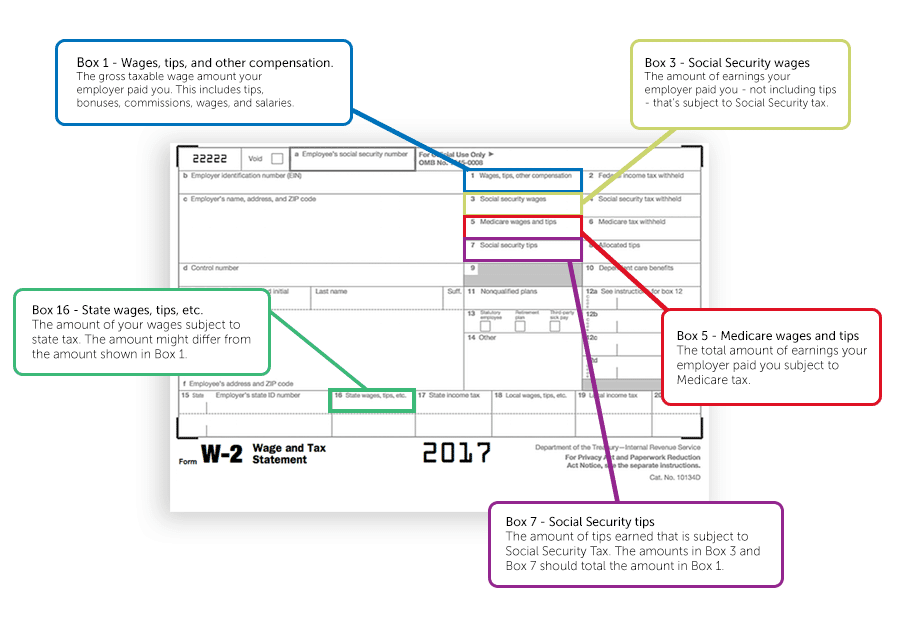

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

To determine Social Security and Medicare.

. Those who make 40000 pay taxes on all of their income into the Social Security system. Knowing how to calculate your W-2 wages can help you to know your total salary and taxable income. Your employer gives Social Security a copy of your W-2 form to report your earnings.

This service offers fast free and secure online W-2 filing options to CPAs accountants enrolled agents and individuals who process W-2s the Wage and Tax Statement and W-2Cs. To figure your total salary you would first find the boxes on the W-2 that. The amount of taxable social security wages is determined by subtracting the following from the year-to-date YTD gross wages on your last direct deposit statement.

However there is a maximum amount of wages that is. The unmodified box method the modified box 1 method and the tracking changes method. In 2020 this amount is 137700.

It takes more than three times that amount to max out your Social Security payroll. Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income. If your box 3 amount differs from box 5.

Calculate Medicare and Social Security Taxable Wages. This is the total amount of money youve earned without deductions or tax. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity.

You earned more than the Social Security wage cap in a given year. When you work as an employee your wages are generally covered by Social Security and Medicare. CALCULATING SOCIAL SECURITY AND MEDICARE TAXABLE WAGES BOXES 3 5 The Social Security Wage Base for 2019 was 132900.

You do not owe social security taxes on any money above that amount. So benefit estimates made by the Quick Calculator are rough. The net amount of this calculation should equal the taxable wages reported on your W-2 for social security box 3 and Medicare box 5.

The first step of calculating your W2 wages from a paystub is finding your gross income. The revenue procedure provides three methods for calculating W-2 wages.

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

Understanding Your W 2 Controller S Office

Documents Store Payroll Template Money Template Money Worksheets

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

W 2 Wage And Tax Statement Data Source Guide Dynamics Gp Microsoft Docs

Form W 2 Explained William Mary

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

A Visual Representation Of How To Do Your Payroll Taxes Infographic Payroll Taxes Payroll Accounting Payroll

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Deductions

What Is Irs Form W 2

A Quick Guide To Your W 2 Tax Form The Motley Fool

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms